direct vs indirect cash flow gaap

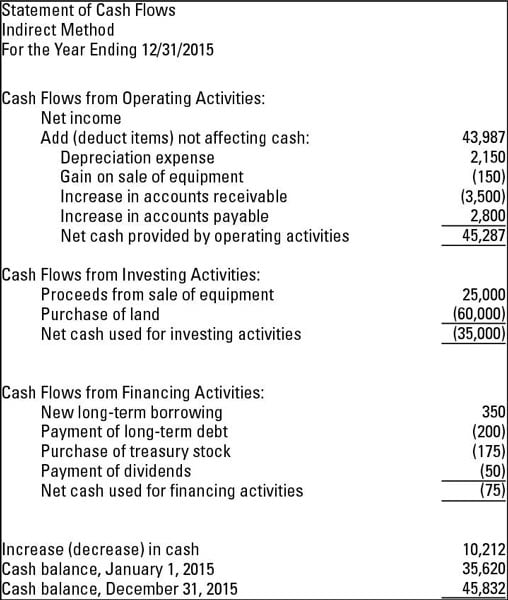

Heres what this equation looks like. Either the direct or indirect Net income must be reconciled to net cash flows from operating activities if the indirect method is used.

Cash Flow Statement Finance Train

GAAP requires that the details of the capital lease are revealed and disclosed in order to demonstrate further legitimacy to the lease.

. The report reflects net income changes in the balance sheet accounts and. This formula is considered the direct method because it adjusts total revenues for the associated expenses. See the Proposed amendments that would affect these classifications under IFRS Standards.

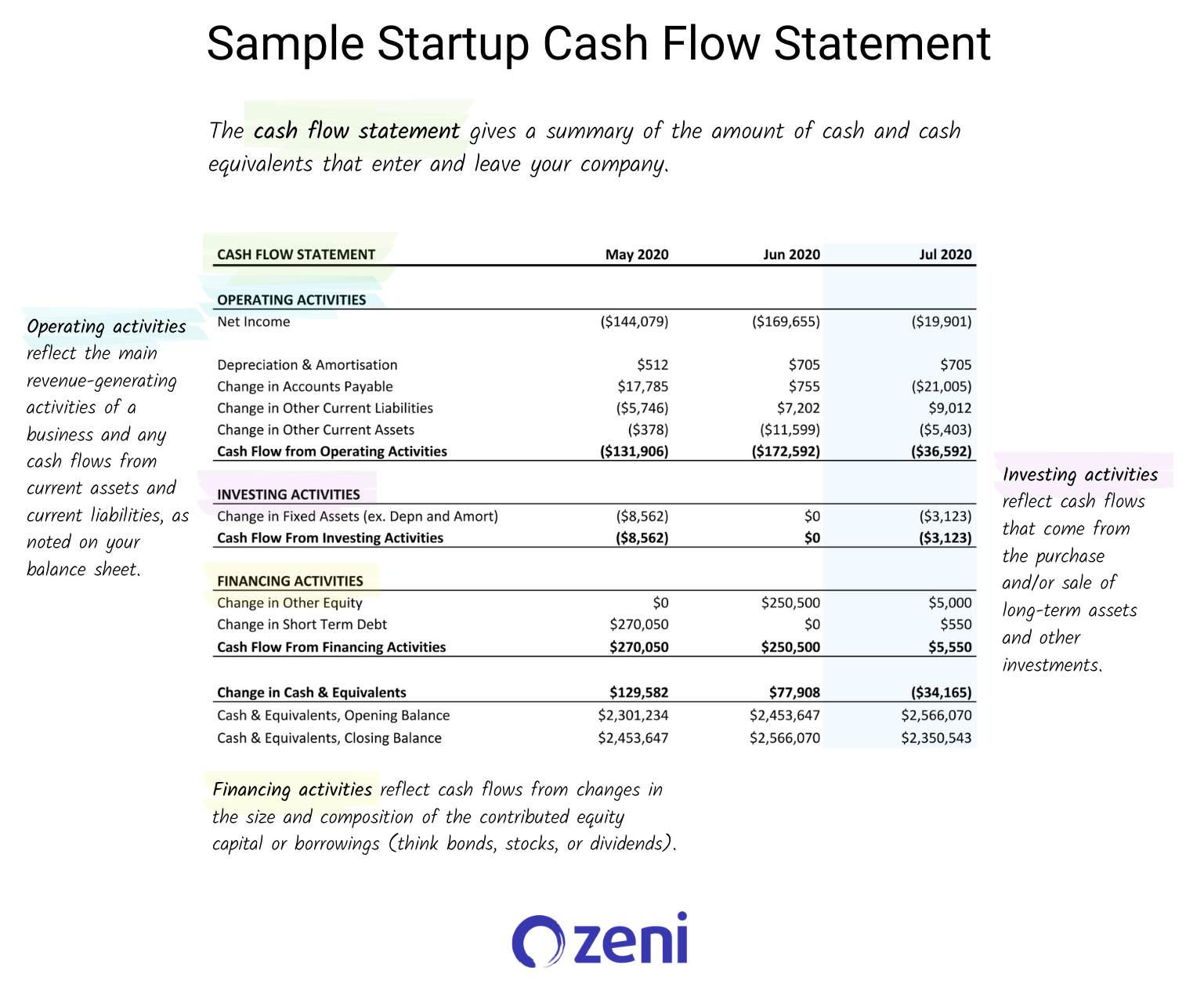

Cash flow statement. Explore the Indirect vs Direct cash flow statement presentation and understand the pros and cons of each Module 5. The direct method and the indirect method.

Most publicly-traded companies use multiple-step income statements which categorize expenses as either direct costs also known as non-operational costs or indirect costs also known as. Other similar investing cavities fund flow also reports in this section. And accounting policymakers and international regulators aim two merge the two systems together for a better outcome.

Cash flow is the net amount of cash that an entity receives and disburses over time. It includes direct and indirect methods. Cash Flow Statement vs.

The indirect method starts with net income and backs out interest expense and taxes. Under IFRS Standards bank overdrafts reduce the cash and cash equivalents balance in the statement of cash flows if they are repayable on demand and form an integral part of the companys cash. Direct vs indirect cash flow.

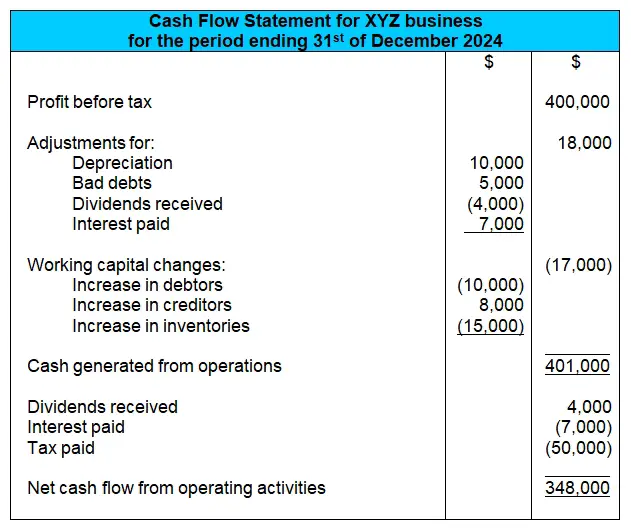

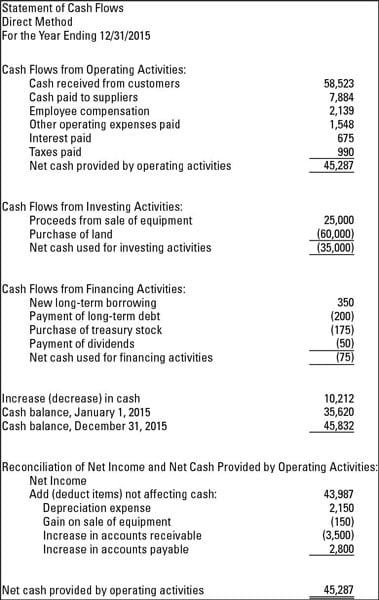

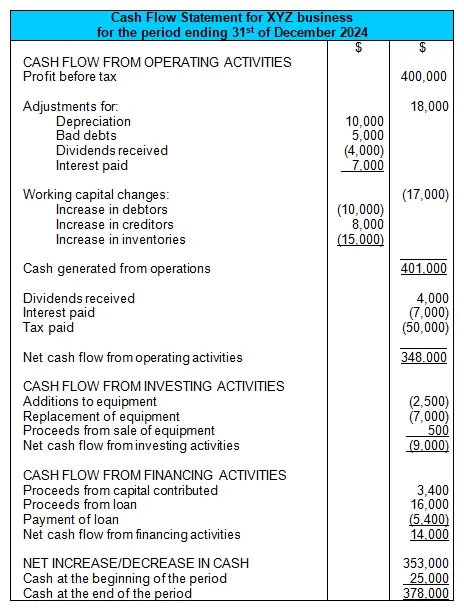

In general the information will be shown based on the cash flow method that the entity prepares. The direct method provides information which may be useful in estimating future cash flows and which is not available under the indirect method US GAAP allows businesses to choose the direct or indirect method but even when using the direct method a reconciliation of cash flow from operating activities to net profit net income is required. Operating Expenses comes down to how COGS are the direct cost of selling productsservices while OpEx is the indirect costs not tied to revenue production.

Here we summarize our selection of the Top 10 GAAP identification and disclosure differences. A statement of financial position a statement of profit and loss ie income statement and a statement of. Why the US GAAP vs IFRS question matters over time in recent years US.

Income statement and cash flow statement. How are COGS vs. Firstly it is to be determined which input costs are indirect by nature for the manufacturing of a product or service deliveryNext add up all these costs together to arrive at the total manufacturing overhead.

Pulling Together the Operating Model Build an understanding of ratio analysis and how these ratios can be used to better understand the nature of the organization. But it is not as easily manipulated by the timing of. Traditional Costing Method.

Balance Sheet The cash flow statement measures the performance of a company over a period of time. GAAP IFRS Relevant guidance ASC 230 IAS 7 Cash flows from operating activities Either the direct or indirect method may be used. GAAP a company using the direct cash flow method needs to disclose to the FASB its reconciliation of net income to cash flow from operating activities.

Not under US GAAP. While generally accepted accounting principles US GAAP approve both the indirect method is typically preferred by small businesses. When accounting for inventory product costs are divided into direct costs and indirect.

Next calculate all the administrative costs and general costs that cant be directly allocated to the manufacturing of the product or service delivery. Which is a required part of the financial statements under both the GAAP and IFRS accounting frameworks. Unlike ABC traditional costing systems treat overhead costs as a single pool of indirect costsTraditional costing is optimal when indirect costs are low compared to direct costsThere are several steps in the traditional costing.

Cash may be net of bank overdrafts under IFRS Standards. Net income must be reconciled to net cash flows from operating activities. 5 Noted to Financial Statements.

Cost of Goods Sold COGS. You can also use the indirect method to derive the EBIT equation. Positive cash flow must be maintained for an entity to remain in business.

Tax disclosures for an entity that issues separate. The US GAAP vs IFRS frameworks both have their own importance. It is reported as part of the financial statements which include the income.

Shows the actual flow of cash into and out of an organization during the accounting period. The reconciliation report verifies the accuracy of the operating activities. Statements of cash flow using the direct and indirect methods In order to figure out your companys cash flow you can take one of two routes.

Note to Financial Statements is the important statement that most people forget about. IFRS vs US GAAP Financial Statement presentation There are many similarities in US GAAP and IFRS guidance on financial statement presentationUnder both sets of standards the components of a complete set of financial statements include. Part of running a company properly is recording operating costs which comprises two categories.

Traditional costing systems apply indirect costs to products based on a predetermined overhead rate. Related party relationships may result from direct or indirect control including common control joint control or significant influence.

Methods For Preparing The Statement Of Cash Flows Dummies

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

How To Read A Cash Flow Statement Zeni

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct Vs Indirect The Best Cash Flow Method Vena

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

27 Understanding Cash Flow Statements

The Indirect Cash Flow Statement Method

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Produce Gaap Compliant Statement Of Cash Flows Reports In Xero Hq Xero Blog

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Methods For Preparing The Statement Of Cash Flows Dummies

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)