does cash app report to irs for personal use

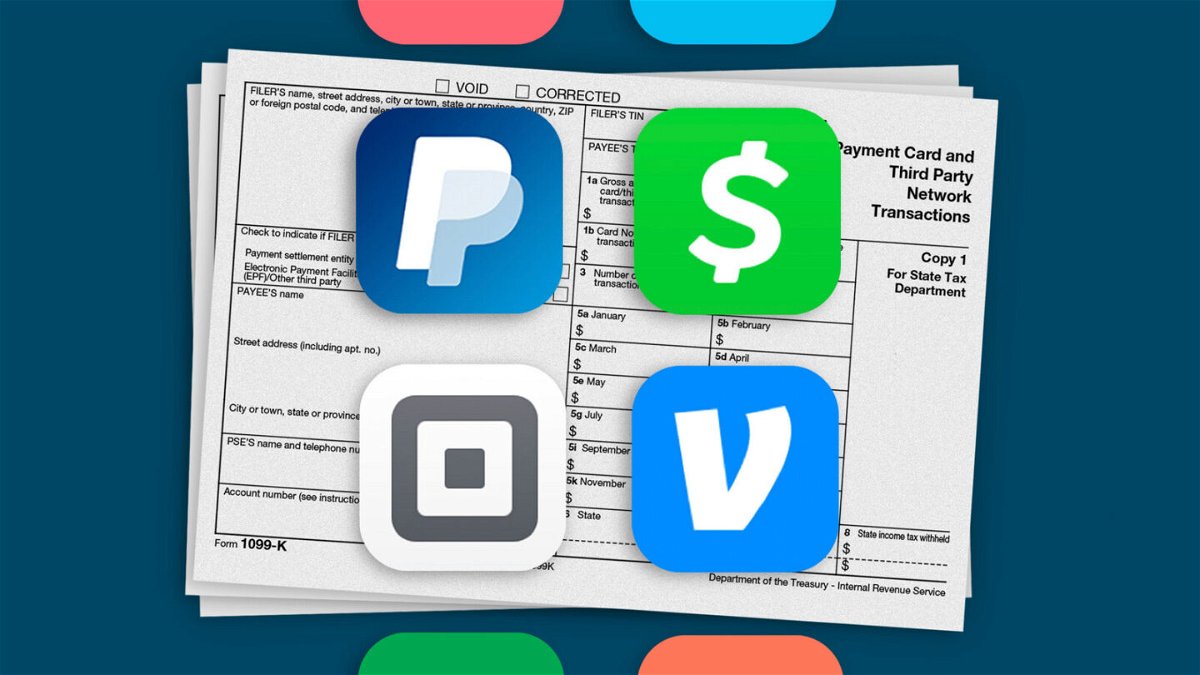

1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. As well as stolen.

How To Easily File Your Cash App 1099 Taxes Step By Step

According to IRS Publication 17 Federal Income Tax Guide for Individuals taxpayers must report this income as self-employment activity and the eFile Tax App will report this on the 1040 form on line 8z or on Schedule C of the tax return.

. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for the change some claiming a new tax. You can choose to report anonymously or you can provide your name.

Some American taxpayers find themselves in the uncomfortable position of witnessing another persons tax evasion and fraud. A personal service corporation must use a calendar year as its tax year unless. Although we cant respond individually to each comment received we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms instructions and publications.

Including name address business identification and everything you know about the fraud. The Internal Revenue Service welcomes whistleblowers. While Cash App Taxes covers many tax forms and situations it doesnt work.

The IRS also has a program that allows you to report tax fraud for a financial reward. Using cash to purchase items that are hard to trace and easy to sell. Cash App Taxes is for people with relatively simple tax returns who only need to file a federal and one state return.

Internal Revenue Service Tax Forms and Publications. For instance a husband and wife could each give 16000 to their child but they would need to report the 32000 to the IRS on Form 709 to properly split the gift between them. This also includes money or income from push money kickbacks side commissions etc.

The Information Referral Form 3949-A is the general form for all types of tax evasion and fraud. You can use this form to report an individual or a business. NW IR-6526 Washington DC 20224.

Report the receipt in the course of a trade or business of more than 10000 in cash or foreign currency in one transaction or. Use IRS Form 3929. 8300 Report of Cash Payments Over 10000 Received in a Trade or Business.

Does Cash App Report To The Irs

How Does The Irs Law Work On 600 Payments Through Apps Marca

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Irs Has New Ways Of Taxing Cash App Transactions

Changes To Cash App Reporting Threshold Paypal Venmo More

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Cash App Income Is Taxable Irs Changes Rules In 2022

Cash App Tax Forms All Tax Reporting Information With Cash App

Cash App Income Is Taxable Irs Changes Rules In 2022 Chosen Payments

Does Cash App Report To The Irs

Tax Changes Coming For Cash App Transactions

How Does The Irs Law Work On 600 Payments Through Apps Marca

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Kesq

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor